Our Blog

First-Time Homebuyer Mortgage Checklist

Embarking on the journey to homeownership is a thrilling milestone, especially when navigating mortgages like FHA loans or conventional home loans. Here’s a step-by-step checklist to guide first...

Read more

Improve Your Credit Score for Optimal Mortgage Rates

Your credit score plays a vital role in securing favorable terms for mortgages such as conventional home loans and FHA loans. A higher score can ensure access to better options like VA loans or...

Read more

Key Tax Changes Property Owners Should Know

Tax laws are ever-changing, impacting property owners ranging from those managing residential homes to commercial real estate investors. The One Big Beautiful Bill Act (OBBBA), enacted on July 4,...

Read more

Key Considerations for Buying a Home

Buying a home is a significant financial decision, involving various mortgage solutions such as conventional home loans, FHA loans, and VA loans. Proper planning is crucial whether you're...

Read more

Unlocking the Advantages of Refinancing Your Mortgage

Refinancing a mortgage can be a strategic move for homeowners looking to enhance their financial situation. Whether you're aiming to lower your monthly payments or access home equity, refinancing...

Read more

Things To Know When Buying A Home

Purchasing your own property is a substantial life milestone, and one that involves many steps and significant financial responsibilities. There are a number of steps to consider before you become...

Read more

What Type Of Home Should You Buy?

If you are a first time homebuyer or if you are looking to relocate and buy a new property, it can often be overwhelming when determining what type of home to buy because of the wide variety of...

Read more

How Does Mortgage Interest Work?

Becoming a homeowner is one of the most impactful purchases that you will likely make in your lifetime, and one of the biggest challenges for a potential homeowner is getting the right type of...

Read more

Student Loan Debt And Purchasing A Property

Do you have your heart set on buying a home, but have concerns that your student loans may be impeding your ability to make that dream become a reality? Even though having student loan debt can...

Read more

Homestyle Loans

Using A Homestyle Loan To Buy A PropertyDo you currently own your own home that needs some renovation, or are you interested in buying a property that is in need of repair? Fortunately, if you need...

Read more

How To Understand Your Credit Score

How To Understand Your Credit ScoreYour credit rating tracks your financial behavior and demonstrates your ability to pay back borrowed money. It will also be a significant component to determining...

Read more

Potential Hidden Costs When Buying A Home

What Are The Potential Hidden Costs When Buying A Home?Have you made the important decision to stop renting and purchase your own property? Becoming a homeowner is a serious and exciting milestone,...

Read more

Most Frequently Asked Questions About Reverse Mortgages

Reverse mortgages are a unique type of financing option that offer older homeowners the opportunity to convert their home equity into cash while still being able to live on the property. As with...

Read more

Renting Vs. Buying A Home – What Should I Do?

Purchasing a property can be a major way to substantially boost your financial security because as you start to make monthly mortgage payments, your home begins to build equity and becomes an...

Read more

Eligibility For SBA Loans

Get The Most Out Of Your Business With An SBA LoanIf you are a business owner and interested in making improvements to your company or buying or renovating a commercial property, there is an...

Read more

VA Loan – Certificate Of Eligibility

The First Step To Getting A VA Loan: Certificate Of EligibilityA VA loan is a mortgage that assists military service members or veterans in becoming a homeowner. There are certain steps that must...

Read more

Tips To Paying Off Your Debt With The Help Of Your Property

People commonly acquire debt by buying services and goods on credit and paying for it at a later date with credit cards, a personal loan, or a mortgage. In the United States, consumer debt is...

Read more

Understanding DSCR

Understanding Debt Service Coverage Ratio In Real EstateInvesting in a real estate property and either reselling it or renting it out for a profit can potentially be a highly lucrative way to...

Read more

HECM – Home Equity Conversion Mortgage

Understanding A Home Equity Conversion MortgageIf you are a homeowner and nearing the age of retirement, and looking for a way to supplement your income, you may want to consider applying for a...

Read more

Commercial Loan Refinance

Refinancing A Commercial LoanAre you a small business owner or do you currently own a commercial property, and interested in obtaining a more favorable rate or term on your mortgage? One refinance...

Read more

Getting Approved For A Home Loan

Tips To Getting Approved For A Home LoanBecoming a homeowner is a huge milestone and is an extremely exciting venture, however, this purchase is significantly expensive. Fortunately, if you are...

Read more

Top Ways To Save Money While Moving

Moving to a new area and relocating to a new property can be exciting, however, it can also be an expensive venture. Fortunately, there are steps you can take to help save money during the moving...

Read more

HELOC: Home Equity Line Of Credit

Do you currently own your own home, and are you looking for a source of additional income? There are certain loan options available that can allow you to access your home equity in exchange for...

Read more

Learn About Cash-Out Refinance

Amplify Your Finances With A Cash-Out RefinanceIf you currently own your own home and your property has accumulated a solid amount of equity, you could potentially turn that value into supplemental...

Read more

Commercial Loans: What To Know

Boost Your Business With A Commercial LoanDo you own and operate your own small business? If you have been thinking about enhancing your company by renovating your current operating space or...

Read more

Conventional Home Loan Options

Understanding Your Conventional Home Loan OptionsAre you ready to become a homeowner and weighing your financing options to determine the mortgage that will be the best deal for your situation?...

Read more

Buying A Property With A Portfolio Loan

Buying A Property With A Portfolio LoanAre you ready to buy a property, but concerned that you might not be able to meet the eligibility requirements of a traditional mortgage or concerned that the...

Read more

Protecting Your Home Against Natural Disasters

The recent hurricanes this season served as a stark reminder that as a Florida homeowner, you want to make sure that your property is fully protected in the event that any accidents or natural...

Read more

Buying A Home When You Have Student Loans

Are you ready to become a homeowner, but concerned that you won’t be able to afford it due to owing money on your student loans? Even though having debts from student loans can greatly impact your...

Read more

Do I Need To Buy Homeowners Insurance?

Ensuring Your Home Is Protected With Homeowners InsuranceAre you someone new to buying a property, and have questions about homeowners insurance requirements and if you even need to purchase a...

Read more

When Am I Required To Start Making Mortgage Payments?

Becoming a homeowner is an exciting venture, and the last step in this busy process is closing on the home. Once all the necessary paperwork is completed and the closing costs have been paid, you...

Read more

Qualifying For A Mortgage When Buying A Property

Are you ready to buy a home and trying to determine a financial plan to afford it? More than likely, you will be required to finance the purchase with a mortgage. To obtain a loan, mortgage...

Read more

What Documents Are Required When Buying A Home?

Understanding The Types Of Documentation You Will Need When Buying A HomeHave you decided that you are ready to become a homeowner, and wondering what kind of paperwork you will need to gather in...

Read more

Understanding Fixed Rate Mortgages

Understanding Fixed Rate Mortgages When Buying A HomeWhen you buy a property, the kind of interest rate that you select will be an important factor to consider when deciding on a mortgage type, and...

Read more

First Time Home Buyer Loan Options

Buying your first home is a significant milestone, and although it is exciting, it can sometimes seem very overwhelming because of the many different factors involved. Since purchasing a property...

Read more

Understanding Bridge Loans

Using A Bridge Loan To Buy A PropertyAre you a homeowner who has been thinking about selling your home and buying an upgraded home with the money from that sale? Although this is an exciting...

Read more

How Does Private Mortgage Insurance Work?

It’s no secret there are many different types of costs associated with purchasing a property, and sometimes it can get complicated to fully understand the required costs when determining your...

Read more

About Conventional Loans

Purchasing A Property With A Conventional LoanAre you ready to buy a property and become a homeowner, and evaluating the kind of mortgage that will work best for your financial situation? A...

Read more

Understanding The Escrow Process

Understanding The Final Step To Buying A HomeWhen purchasing a property, there are several steps you need to take in order to finalize the transaction, and the final step, known as escrow, can...

Read more

Saving For A Down Payment

Tips For Saving For A Down PaymentAre you tired of renting and ready to take the steps to buy your own home? Shopping for your dream home and saving up enough funds for the down payment is a...

Read more

Exploring Opportunities With Investment Properties

Exploring Investment Property OpportunitiesThere can be numerous benefits to owning an investment property and there is potential for it to be a significant source of supplemental income. Buying a...

Read more

Mortgage Refinance Information

Reaching Your Financial Goals With A Mortgage RefinanceAre you a current property owner who is interested in refinancing your home loan in order to help improve your financial situation? A mortgage...

Read more

How Does Credit Score Affect Mortgage Rates?

How Does Credit Score Affect Mortgage Rates?When buying a property, the interest rate of your mortgage will impact the total price that you’ll pay throughout the duration of your loan. A borrower’s...

Read more

Understanding Closing Costs

How To Better Understand The Final Step In Purchasing A PropertyThere are many steps you need to take in order to purchase a home, and the final step in the process is paying closing costs, which...

Read more

Portfolio Loans

Buying A Property With A Portfolio LoanAre you interested in buying a home, but apprehensive to apply for a mortgage because you may not be able to adequately meet standard loan eligibility...

Read more

Understanding The Home Appraisal Process

Determining A Home’s Value With An AppraisalAre you interested in buying a property, selling a home, or refinancing an existing mortgage? One necessary step in any of these situations involves...

Read more

Investment Property Loans

Boosting Your Income With An Investment Property LoanHave you been thinking about buying a property with the intention of renting it out or selling it for a profit? An investment property loan,...

Read more

Understanding The Differences Between Bank Statement Loans And Traditional Mortgages

Are you someone that is self-employed, or have an untraditional form of income and interested in purchasing a property, and concerned about qualifying for a mortgage because of your inability to...

Read more

The Pros And Cons Of A DSCR Loan

Have you been contemplating buying a property with the intention of either reselling it, or renting it out as a profit, and want to know what your financing options are? When you invest in real...

Read more

Reverse Mortgage: Frequently Asked Questions

Get Better Rates And TermsIf you are an older, retired homeowner interested in paying off your existing mortgage as well as obtaining some additional income, there is a unique loan opportunity...

Read more

Refinancing A VA Loan

Get Better Rates And Terms By Refinancing A VA LoanAre you a current homeowner who purchased your property with a VA loan, and interested in paying less for your monthly mortgage payments and...

Read more

Loan Options For Consolidating Debt

Loan Options For Consolidating DebtConsumer debt accrues when people purchase goods and services on credit and pay for it later with credit cards, loans, and mortgages. Consumer debt is at an all...

Read more

Non-QM Loans: Frequently Asked Questions

Non-QM Loans: Frequently Asked QuestionsA non-QM loan, or non-qualified mortgage, is one option that can help a potential borrower become a homeowner, particularly if they earn their income in a...

Read more

Supporting Our Veterans With VA Loan Options

Are you a United States veteran or someone that is currently serving our nation in the military and interested in becoming a homeowner? The United States Department of Veterans Affairs, (or VA),...

Read more

The Different Ways A Jumbo Loan Can Help You!

Have you been interested in purchasing a property that perhaps comes with a higher price tag, and curious about the types of financing that are available for you to meet that goal?If your ideal...

Read more

Non-QM Loans For Self-Employed Borrowers

Are you interested in purchasing a home, but perhaps concerned that you may be unable to qualify for a loan because you have an untraditional source of income? Non-QM loans are intended to help...

Read more

How A Reverse Mortgage Can Help You Attain Financial Freedom In Your Retirement

If you are a homeowner of senior citizen age interested in acquiring some supplemental income or buying a new property, you might be able to utilize your current home’s equity to help you finance a...

Read more

CTC Mortgage partners with Sun Sentinel

Check out the article in the sponsored section of Sun Sentinel! Debunking 5 misconceptions about reverse mortgages:https://www.sun-sentinel.com/sponsor-content-article/?prx_t=o44IAs8dgA50QQA...

Read more

Mortgage Spam Calls and Mail

Does your phone light up with dozens of calls from unknown caller every day?In this day and age where spam calls, robo dialing, and “I have been trying to reach you about your extended warranty,”...

Read more

10 Reasons to Work With a Mortgage Broker

For most people, a home is the biggest purchase they will ever make. When you buy a home, and get a mortgage, you are signing a 30-year contract involving hundreds of thousands of dollars. That’s...

Read more

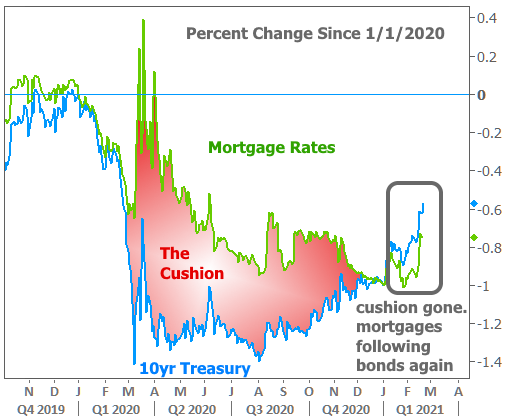

One of the Biggest Paradoxes

One of the Biggest Paradoxes You’ll Ever See for Mortgage Rates No, this isn’t one of those click-bait headlines that promise to share “one weird trick” or proclaim “you’ll never believe what...

Read more

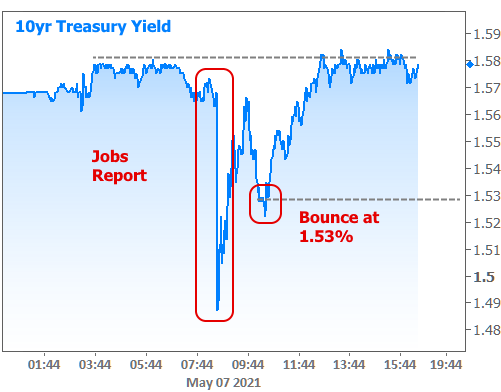

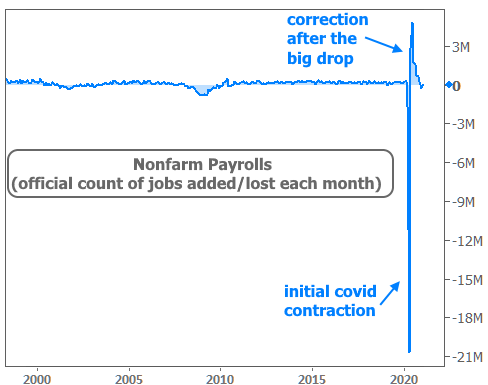

What This Week’s Job Report Means for Rates

All eyes were on the big jobs report this week. Traders were anxious to see if it would be strong enough to accelerate the timeline for key policy changes that would greatly impact rates.The bond...

Read more

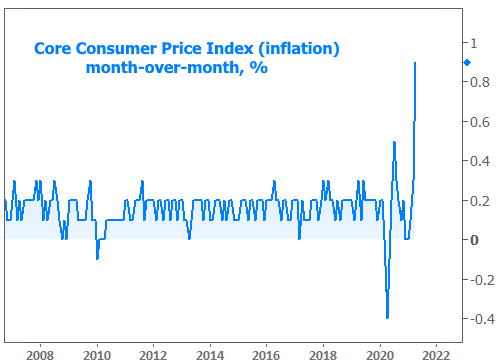

Highest Inflation in Decades

But Housing has a Bigger Problem Inflation is bad for interest rates and it’s at the highest levels in decades. But the housing market has a far bigger problem.Actually, it’s not hard for a problem...

Read more

What Are Rates and Housing Worried About?

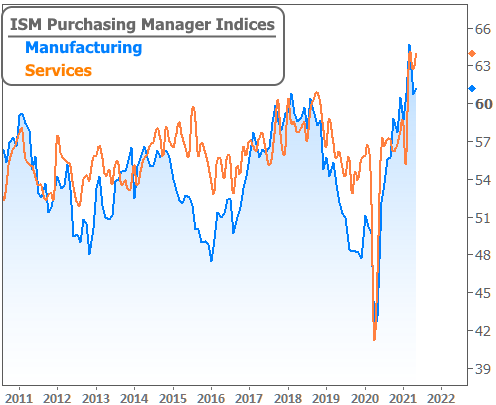

In the past 2 weeks, there’s been big news about inflation and seemingly big news about Fed policy. Both are threats to low interest rates, but not just yet, apparently. So, what’s the worry?After...

Read more

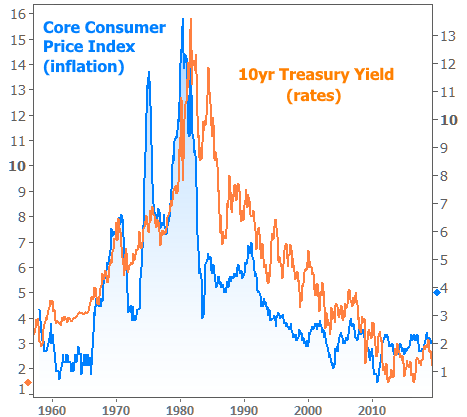

Big Inflation Scare

Rates Remain Resilient The 70’s and 80’s brought unforgettable economic lessons about inflation. Since then, certain market participants have been watching inflation like hawks, even when they didn...

Read more

Rates Reacted to Jobs Report

…But Not Like You’d ExpectOnce a month, the government releases the Employment Situation, also known as “the jobs report.” No other piece of economic data is as consistently relevant for the bond...

Read more

Moment of Truth for Rates and Housing

This week’s 6.4% reading on Q1 GDP reinforced the notion of a strong economic recovery. In turn, the recovery helps to justify the sharp move higher in rates seen during the same 3 months. Rates...

Read more

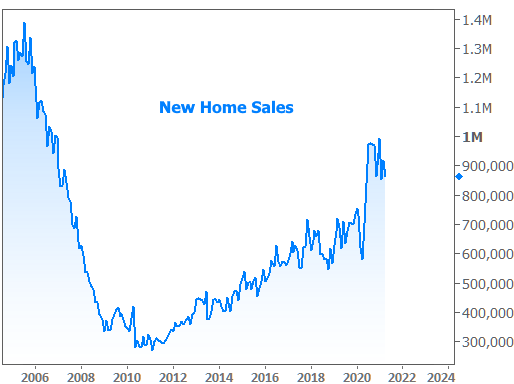

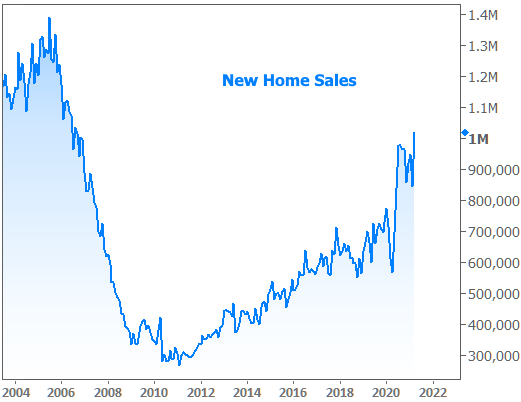

15-Year High For New Home Sales

15-Year High For New Home Sales, But Prices Are Flat. Here’s Why: Published April 26, 2021This week’s New Home Sales report (for the month of March) stole the show, coming in over 1 million for the...

Read more

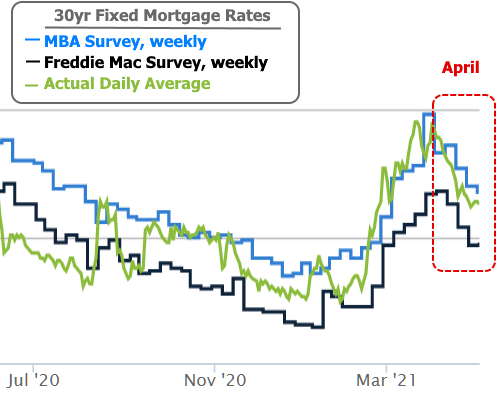

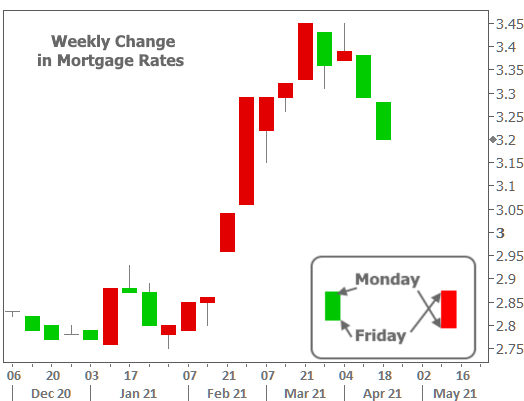

Best 2 Weeks For Rates in Nearly a Year

The bond market has been pointing toward higher rates since last August. Mortgage rates were able to defy that trend at first, but finally began spiking in the new year. February and March were...

Read more

Victory For Rates; Hope For Housing Inventory?

2021 hasn’t been a great year for mortgage rates–at least not as far as their trajectory is concerned. But that could be changing. Even if things don’t get any better from here, the past 3 weeks...

Read more

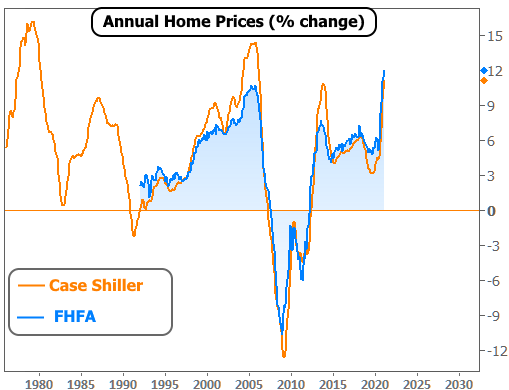

Who’s Lying About The Housing Market?

The housing market is heating and cooling at the same time, depending on the data in question. Who’s telling the truth? Actually, maybe everyone…According to home price appreciation, the market is...

Read more

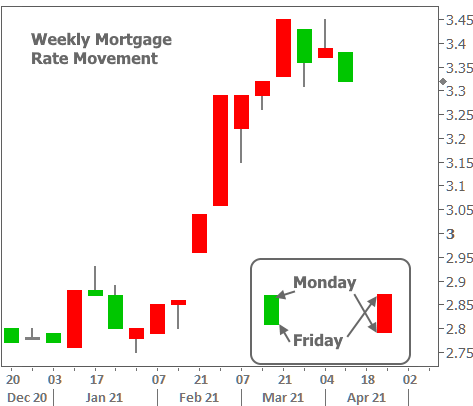

Rates Catch A Break

Will It Last? What’s The Impact On Housing? The biggest story for the mortgage and housing market so far in 2021 has been the big spike in mortgage rates. It has been more abrupt and covered more...

Read more

More Mortgage Drama

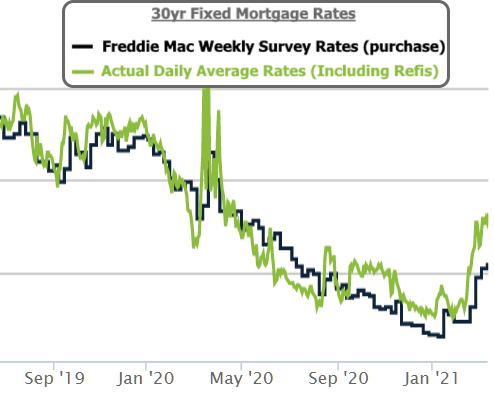

– Especially for Investment and Second Home Loans Most of this week’s mortgage rate coverage focused on a fairly gentle increase of 3.05 to 3.09 for the average 30yr fixed. That number comes from...

Read more

Highest Rates In A Year

… Big Drama For Investment Property Homes Rising rate headlines are nothing new, but there was a bit of a double whammy this week… or triple, depending on your point of view.Whammy 1: Highest Rates...

Read more

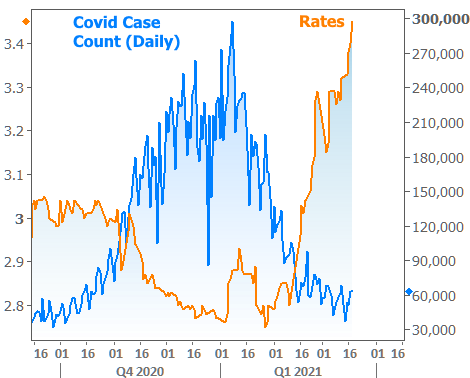

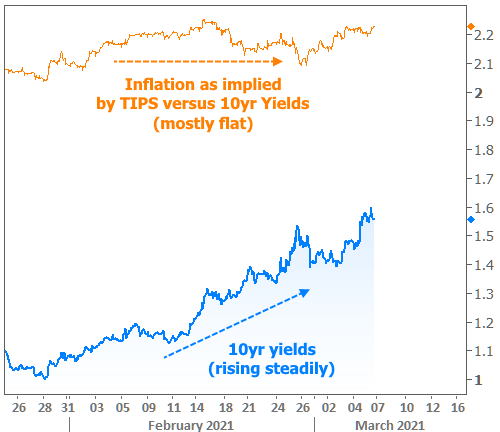

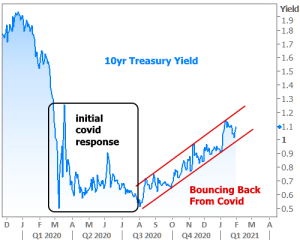

Rates Rising Relentlessly, But Why?

When Will They Stop? Interest rates can’t seem to catch a break. February was one of only a handful of months in the past 2 decades that resulted in a 0.50% mortgage rate spike. Despite hopes to...

Read more

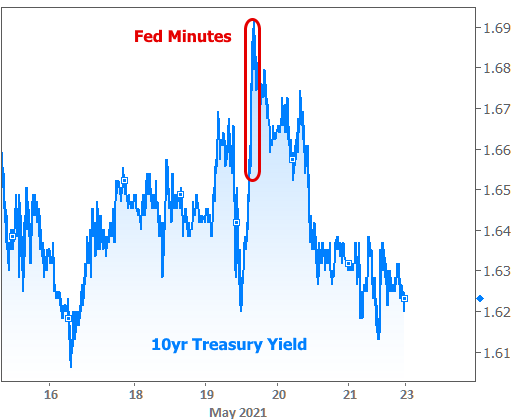

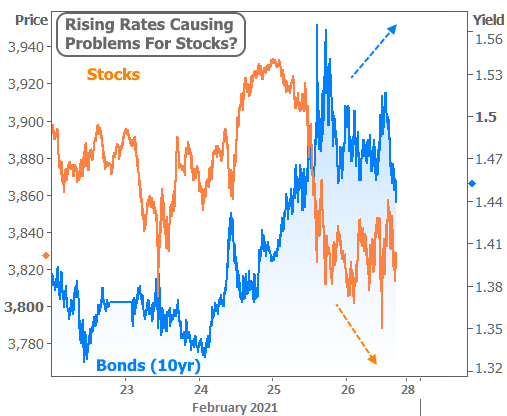

Brutal Week For Rates

… But There’s Hope (Hopefully) Rising rates have been on the menu for months, but the drama kicked into a higher gear this week.Maybe you heard about this? We’ve certainly been discussing it in...

Read more

Time To Wake Up

Time To Wake Up To The New Mortgage Reality Published February 22, 2021There’s no precedent for the winning streak enjoyed by mortgage rates in the 2nd half of 2020. We’ve never seen so many new...

Read more

Yes, Mortgage Rates Are MUCH Higher This Week

Volatility has returned to the mortgage market in grand fashion this week with many lenders quoting rates that are as much as a quarter of a point higher than they were last week. That means if...

Read more

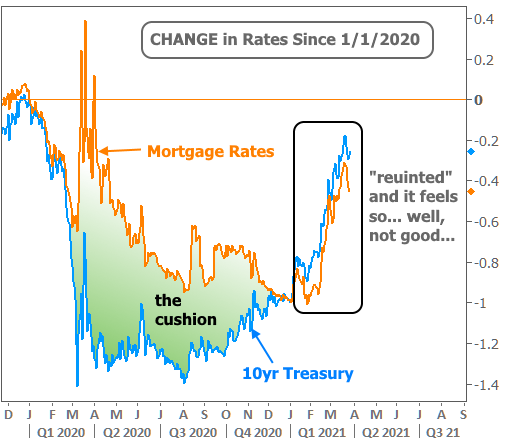

Mortgage Market and Rising Rates

When Will the Mortgage Market Actually Care About Rising Rates? There’s an obvious trend toward higher rates as far as Treasury yields are concerned. This goes all the way back to August....

Read more

Rates Under Pressure

Rates Under Pressure, Despite Weak Jobs Report Newsletter Published February 5, 2021Economic data is traditionally one of the key contributors to interest rate movement. Of the regularly-scheduled...

Read more

Rising Rate Risks Returning

Rising Rate Risks ReturningJanuary 29, 2021 NewsletterAfter spiking in early January, interest rates returned to near-all-time-low levels by the middle of the week. By the end, however, the market...

Read more

More Stellar Housing Numbers

More Stellar Housing Numbers. How Long Can They Last?January 22, 2021 NewsletterWhile it wasn’t quite the biggest surprise of 2020, the strength of the housing market was one of the best. The just...

Read more